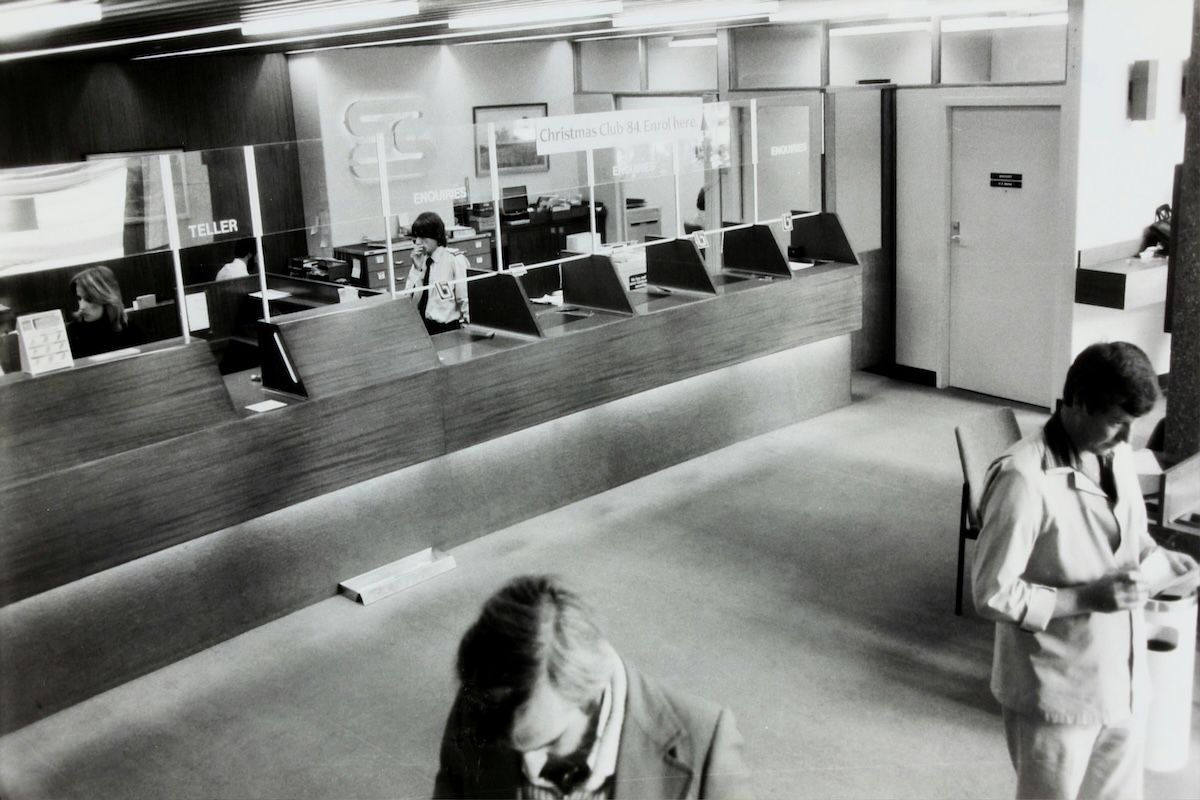

Bank of Canada Rate Cuts Spark Hope for Housing Market Revival Amid Balanced Conditions

Image by: unsplash

RBC Economics forecasts that the Bank of Canada will implement another 50-basis-point rate cut in December, following a similar reduction in October. This anticipated easing could gradually boost homebuyer activity, as observed in the modest sales increase from August to September. RBC’s Monthly Housing Market Update highlights that rate cuts could open doors for potential buyers who have been waiting on the sidelines, improving housing affordability across Canada.

Sales have seen consecutive growth, and RBC economists expect this trend to continue as rate cuts deepen. At the same time, sellers have become more active, with new listings rising 4.9 percent in September, the largest increase since mid-2023. This influx of inventory is rebalancing the supply-demand dynamics that shifted during the pandemic, with more balanced conditions emerging in markets like Toronto due to increased condominium completions, which have eased some pressure on buyers.

Property prices have remained largely steady, with the national MLS Home Price Index barely changing from August to September. However, price shifts vary by region; Vancouver, for example, saw its sales-to-new listings ratio drop, favoring buyers and leading to slight price declines. In contrast, areas with tighter inventory, such as parts of the Prairies and Atlantic Canada, are experiencing mild price gains. RBC predicts that affordability challenges and rising inventories will temper price increases, even as demand grows, with a gradual appreciation expected through 2025 as interest rate cuts continue.

Read the full article on: REAL ESTATE MAGAZINE